Millennial Impact Fellow Gathering Reflection: Seth Saeugling

Seth Saeugling, a Social Innovator and a 2017 New Profit Millennial Impact Fellow, reflects on his time at the 2017 Gathering of Leaders

May 1, 2017 Many of us are just starting to wake up to how divided our country truly is.

Many of us are just starting to wake up to how divided our country truly is.

The power of philanthropy in the United States is undeniable. Foundations granted over $60 billion dollars last year. The divide between urban and rural is exposed when you realize that 1 percent of grant dollars and 0.3 percent of grant-making foundations were awarded to rural communities.

The impact investing sector, where donors invest in companies and organizations that generate a measurable benefit to society or the environment, continues to grow in size year over year. This is a very positive cultural shift that is happening. Make more than just a financial return. Do good for others.

Incredible organizations like Tipping Point (CA), Robin Hood (NY) and New Profit (MA) are exemplars in applying these impact investing lessons of the business world to the social sector. But the election this past November was a wake-up call to America: we have to do better for our rural communities that have been totally left behind and forgotten.

Key Takeaways from New Profit’s Gathering

The Gathering helped me understand three reasons why the urban philanthropy community has missed the needs of rural Americans and opportunities to invest:

An empathy gap: Urban areas often have misperceptions of rural people and places

Isolation: Rural communities’ are isolated from the philanthropy world

Lack of framework to measure needs and drive investment to rural America: Urban philanthropy has been built upon the vision of big numbers and scaling up

The empathy gap is real. I grew up in Iowa, and have spent my professional life between major urban centers (Oakland, Minneapolis, Raleigh) and rural Eastern North Carolina. I’ve seen first-hand how people in urban areas view rural America as a conservative place where the country grows its food. Everyone has heard about failing inner-city schools but are shocked to find that rural communities are home to some of the most severely struggling education systems most deeply entrenched generational poverty in all of America. The first time my aunt drove through my new home in Warren County, North Carolina she was shocked to see trailer after trailer that didn’t have running water or reliable electricity. Here. In America. We think of these problems as “over-there” across some distant ocean. Not less than one hour outside of the cities we call home.

Isolation also makes sense: The wealth that is built in cities then becomes tied to networks and people who are focused on urban problems. Our lives are determined by the social networks we are plugged into. And these networks rarely, if ever, cross the urban-rural divide.

But I want to dive into the last reason why urban philanthropy has failed to invest in rural America: We are comparing apples to oranges and tricking ourselves that we are all talking about the same thing.

The Evolution of Impact Investing

Modern impact investing has been built on the allure of scale. Impact = size. Bigger scale = serving more people. With this worldview, philanthropy will never see the size of rural communities as valid of attention and resources. Why should I fund this school district in rural that has 1200 kids, when I can fund this urban school district that serves 120,000 kids?

The industrial revolution trained businesses to go after the biggest market possible. But our 21st century economy has given rise to businesses that dominate specific niche markets. The goal has become to build products tailored to the exact needs of a small group of people. Post-industrial wisdom says to start small and focus on niche markets.

The Gathering highlighted the massive opportunity that exists today to build a framework that will drive investment into small, niche markets (aka communities) that makeup rural America.

An Example

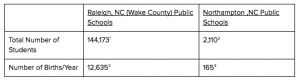

We are often seduced by scale. Compare the scale of the two communities below, which are located 100 miles away from each other.

Using the tools of impact investing, your goal is to dominate and win the largest possible market. If our most important metric is potential market size and potential scale reach when trying to measure the impact the Raleigh public schools are going to win. Every. Single. Time.

Raleigh is the capital of North Carolina. Wake County is one of the fastest-growing counties in the country, adding thousands of jobs and residents a year. Its economy is thriving and has a very active philanthropy community. There are many assets, from human-capital to strategy & resources, that exist in urban Raleigh, just 90 minutes away from rural Northampton.

Return on Investment

The holy grail of impact investing is ROI (return on investment), which measures the gain or loss generated on an investment compared to the amount of money invested. For example if you invest $1 million in a hospital and the community saved $1.5 million in future health costs the ROI would be 50%, which is very high. The greater your ROI, the greater your impact.

I deeply believe in and share this value. ROI is why I’ve re-oriented my career from working with 18 year old students to supporting zero to three year olds and their parents. The more resources you invest earlier in a child’s life, the greater the potential for a high ROI.

However, our current tools and metrics for impact investing are missing some of the highest return on investment opportunities in the entire country: anti-poverty programs in rural America.

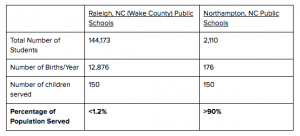

Let’s go back to our Raleigh example. Say you have $300,000 to invest in a parent-support program that provides parenting classes & resources to first-time parents. At $2,000/year per child this could serve 150 parents. And this is where philanthropy becomes seduced by scale. There are over 12,600 babies born a year in Raleigh. Compared to 176 in Northampton. So the money will go to Raleigh.

But that $300k investment could hit just over 1% of the babies born that year in Raleigh. Whereas the same $300k could be used to impact over 90% of the total population of the entire county in Northampton. Think about that for a moment. You could potentially move outcomes for an entire generation of children with a fraction of the resources required in urban settings.

Our Opportunity

Additionally, one asset of rural communities hold in comparison to urban, is a much lower cost of living compared to urban. So you could run the above program for less than $300k. Based on conservative estimates you could save $40k and serve the save number of children. That’s $40k to invest in quality improvements, increase number of kids served, or invest in other high impact issue areas.

Infrastructure challenges are real. We are not naive enough to believe that you can “parachute” or “drop-in” evidence-based programs that have been designed for an urban setting and expect exactly the same outcomes in rural communities. But we do believe that rural communities hold their own in dollar-for-dollar comparisons in return on investment when working to show a measurable impact on the people a program serves.

We Are Framing the Problem Incorrectly

The problem is not the deficiency of rural communities, it’s our framing of the problem. We wrongly believe that we are comparing “apples to apples” when we compare the scale and population sizes, but this is really an “apples to oranges” comparison. True “apples to apples” would include additional measurements like the percentage of a total population that is impacted by an intervention.

Rural communities also present a ripe opportunity to be the “innovation labs” to answer philanthropy’s most pressing challenges and questions. Insights on how to effectively drive systems-level change (at scale!) can be gained for a fraction of the cost and time it takes to even begin to approach the same answers in urban communities.

Our Challenge

The Gathering inspired a challenge within me: How do we take the brilliant resources, frameworks and methodologies of impact investing and apply them to a rural context?

A clear answer to this question could be the inflection point that begins driving the wealth and resources of urban communities into our forgotten rural areas. Philanthropy, as a sector, has an incredible opportunity to use their expertise, knowledge, and passion to build bridges between our divided country, drive investment, and create meaningful change for people who have felt totally left out from the past 50 years of American progress and increased prosperity.

We Can Do This

This will not be easy. Meaningful work never is. I know it is within our individual and communal ability to solve this problem.

Thank you New Profit for the opportunity to attend Gathering through your Millennial Impact Fellowship, I would not have been in the room without your generosity and your thoughtfulness to include rural communities.

Appendix: A beacon of hope for rural communities

Our country has experienced intense urbanization over the past 150 years as our economy transitioned from agricultural and industrial to an information & skills driven economy. While this progress has been exciting and positive, many urban centers are beginning to reach their constraint limits on resources. Overcrowding, and -packed freeways and roads. Intense housing bubbles that prevent people from owning homes. Lack of basic social services being available like child care and quality school options. These challenges are solvable but as more people continue to move to urban areas these challenges will likely grow. Rural America has many assets to offer from lower land and housing costs to a return to community-based networks of deeper networks relationships of relationship/support. Rural America could provide a great choice for many millennials, especially in the next 5-10 years when this generation begins to “settle down” and begin raising families. This could drive new investment of money and human capital into our forgotten rural communities.

Read more from our other Millennial Impact Fellows here!